Moreover, financial literacy packages and counseling services are available to coach students on budgeting, debt administration, and understanding rates of interest.

Moreover, financial literacy packages and counseling services are available to coach students on budgeting, debt administration, and understanding rates of interest. Participating in these applications can empower debtors to make knowledgeable decisions and scale back the long-term monetary impacts of their lo

Risks Associated with Additional Loans

While additional loans include benefits, they are not without risks. One major concern is the accumulation of debt. Borrowers could find themselves in precarious financial situations if they take on extra debt than they will handle, resulting in monetary strain or defaulting on lo

Generally, unsecured private loans might be easier to acquire for these with good credit score scores and monetary histories. However, secured loans such as house fairness strains may require collateral, which some borrowers discover more accessible. It’s essential to gauge your choices and select a mortgage type primarily based in your financial capabil

Before taking out an additional mortgage, consider elements such as your present financial stability, current debts, and ability to repay the

Loan for Credit Card Holders.

Additionally, assess your credit score score, mortgage terms, rates of interest, and the intended use for the mortgage proceeds to ensure that borrowing is in your greatest financial curios

Understanding Debt Consolidation Loans

Debt consolidation loans are designed to mix several existing money owed into one manageable payment. Often, individuals might find themselves overwhelmed with multiple bank card payments, private loans, or medical debts. By obtaining a debt consolidation loan, they can pay off these varied debts and leave them with a single month-to-month paym

Student loans are a major financial tool for many individuals pursuing higher training. They allow students to afford tuition, books, and dwelling bills when own funds are inadequate. However, understanding the varied types of loans, their terms, and repayment options is crucial for leveraging them effectively. Institutions and college students alike must navigate the intricate landscape of pupil finance. In this text, we aim to provide a comprehensive overview of student loans whereas additionally highlighting the resources out there through 베픽, a premier platform for pupil

Daily Loan data and revi

Federal student loans are funded by the government and usually provide lower rates of interest and higher repayment choices than non-public loans. Private loans are issued by banks or monetary institutions and may have greater costs and fewer borrower protections. Understanding these differences is essential for making informed financial choi

Lastly, asking concerning the shop's insurance policies concerning loans, extensions, and the sales of unclaimed gadgets will give potential debtors a clearer picture of what to anticipate if they choose to pawn their belongi

When contemplating a mortgage, it’s important to gauge your financial scenario, as it will affect your borrowing restrict and compensation capabilities. Keep in mind that the amount you can borrow often is decided by components such as your income, credit historical past, and whether you're an undergraduate or graduate scho

Additionally, **lack of documentation can result in predatory lending practices**. Some lenders may reap the benefits of debtors in urgent need of funds by imposing unfavorable phrases. Therefore, it's crucial to conduct thorough analysis and understand lender practices earlier than committing. This aligns with the function a platform like 베픽 plays, providing vital insights and evaluations on various lenders in this ho

To effectively handle repayments, create a finances that includes your mortgage payment alongside your different bills. Setting up automatic funds might help keep away from missed funds. Additionally, contemplate making additional payments when possible to reduce back the principal balance faster, which might save on interest costs over t

Users can find detailed analyses of different lenders, ideas for choosing the proper

Loan for Unemployed mortgage, and recommendation on managing debt successfully. Furthermore, BePick provides instruments that enable visitors to check totally different loan choices, guaranteeing they find probably the most suitable resolution for their monetary situat

One of the primary reasons borrowers go for no-document loans is the **quick approval process**. Since lenders require less paperwork, debtors can typically obtain funds inside a short span after applying. Additionally, these loans could be interesting throughout conditions the place conventional documentation is hard to secure, corresponding to when making use of for funding after beginning a model new business or in periods of financial transit

Another vital profit is that pawnshops do not require in depth documentation or lengthy processing times. Customers simply convey in their gadgets, and the pawnbroker appraises them on the spot. This comfort simplifies the borrowing process substantia

How Large of a Pot Do I Need for Repotting Plants?

bởi madgefny173280 Khám phá top 3 mạng xã hội hàng đầu tại Việt Nam: Sự trỗi dậy của Ketnoi.net

bởi Trùm Bang hội

Khám phá top 3 mạng xã hội hàng đầu tại Việt Nam: Sự trỗi dậy của Ketnoi.net

bởi Trùm Bang hội Betting on K-Dramas? Dive into the Exciting World of Korean Sports Betting Sites!

bởi arielrollins9

Betting on K-Dramas? Dive into the Exciting World of Korean Sports Betting Sites!

bởi arielrollins9 Betting within the Land of the Morning Calm: An Enthralling Guide to Korean Gambling Sites

bởi chadwickpugh07

Betting within the Land of the Morning Calm: An Enthralling Guide to Korean Gambling Sites

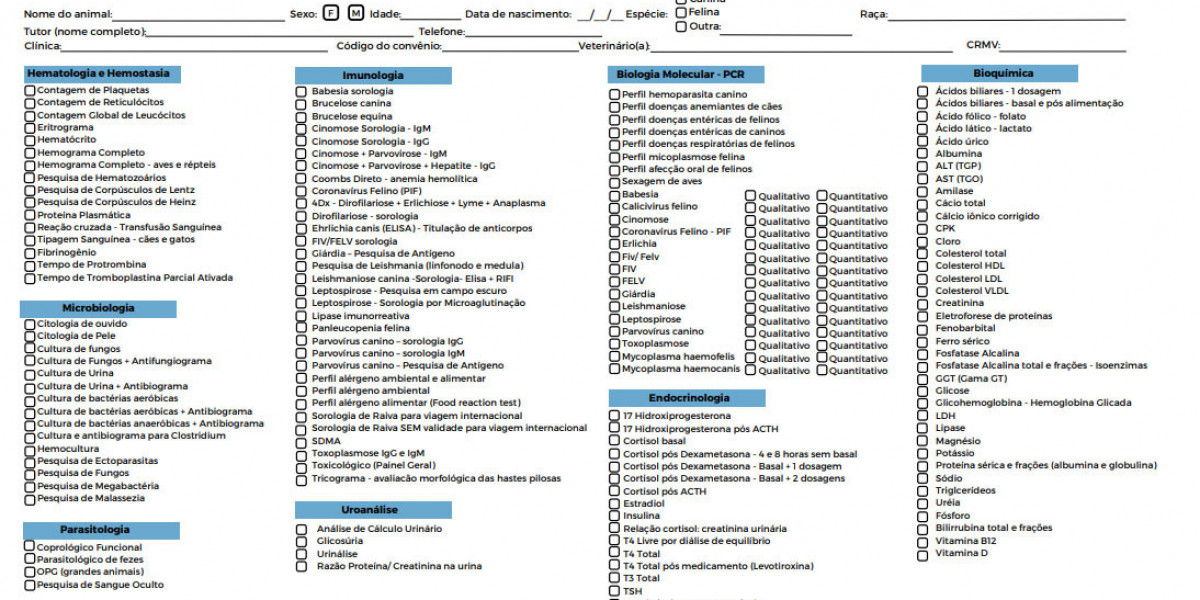

bởi chadwickpugh07 Creatinina alta en perros Síntomas, causas y tratamiento

bởi marialetciafer

Creatinina alta en perros Síntomas, causas y tratamiento

bởi marialetciafer